FICO Scores

With so many different credit scoring models available to consumers it can be confusing when applying for a home loan. When applying for a home loan, over 90% of mortgage lenders will be using the Fair ISAAC FICO scoring model. Your FICO score used by your mortgage lender can be viewed at www.myfico.com. The current versions of the FICO score accepted by Fannie Mae and Freddie Mac are Equifax Beacon 5.0, Trans Union Classic 04 and Experian Fair ISAAC Score 2.

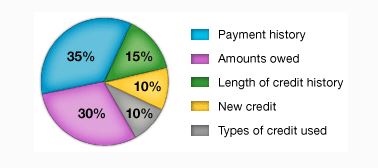

FICO® Scores are calculated from several different pieces of credit data in your credit report. This data is grouped into five categories as outlined below. The percentages in the chart reflect how important each of the categories is in determining how your FICO Scores are calculated. The range of FICO scores is 300 – 850.

Your FICO Scores consider both positive and negative information in your credit report. Late payments will lower your FICO Scores, but establishing or re-establishing a good track record of making payments on time will raise your score.

How a FICO Score breaks down

How a FICO Score breaks down

These percentages are based on the importance of the five categories for the general population. For particular groups—for example, people who have not been using credit long—the relative importance of these categories may be different. For additional information on what your FICO score consists of and how to improve your score please click HERE.

Each loan program offered by Nova may have different FICO score requirements. The loan officer you have chosen to work with will be able to provide you with the score requirement once you have agreed on which type of mortgage (FHA, VA, Conventional, USDA, etc.) you would like to proceed with. Additionally, Nova Home Loans has a team dedicated to assisting you to improve your credit rating in order to qualify for a mortgage free of charge. Please ask your loan officer for information on our Credit Services program.

Low/High FICO Scores

Freddie Mac has given us an indication of low vs. high scores on their Gold Measure Worksheet.The following scale assesses Risk Units (RUs) for a borrower:

- Borrowers with a score above 760 are in the “high” range. The score is positively compensating.

- Borrowers with a score between 680 and 760 are in the “mid” range. The score does not add anything to the files, but does not detract.

- Scores from 680 to 620 are low but can be acceptable. Approvals must be justified carefully and files documented thoroughly.

- Scores below 620 are very “low” and may not be acceptable for conventional financing.

- A score below 600 is probably prohibitive.

Reason Codes

In addition to the FICO score, each credit report will also show four reason codes. The reason codes identify areas of the borrower’s credit profile warranting attention; they tell you why the credit score is as it is.

Dispute Credit Errors

Your credit report is a type of consumer report; it contains information about where you work and live and how you pay your bills. It also may show whether you have been sued, arrested or have filed for bankruptcy. Companies called Consumer Reporting Agencies (CRAs) or Credit Bureaus compile and sell your credit report to businesses. Because businesses use this information to evaluate your applications for credit insurance, employment, and other purposes allowed by the Fair Credit Reporting Act (FCRA), it’s important that the information in your report is complete and accurate. Some financial advisors suggest that you periodically review your credit report for inaccuracies or omissions. This could be especially important if you’re considering making a major purchase, such as buying a home. Checking in advance on the accuracy of information in your credit file could speed the credit granting process.

For more information, please visit the FTC Identity Theft Website at

https://www.consumer.ftc.gov/features/feature-0014-identity-theft

Get Credit Reports

If you’ve been denied credit, insurance, or employment because of information supplied by a CRA, the FCRA says the company you applied to must give you the CRA’s name, address, and telephone number. If you contact that agency for a copy of your report within 60 days of receiving a denial notice, the report is free. In addition, you’re entitled to one free copy of your report per year if you can prove that:

- You’re unemployed and plan to look for a job within 60 days.

- You’re on welfare.

- Your report is inaccurate because of fraud.

- Otherwise, a CRA may charge you for a copy of your report. If you simply want to purchase a copy of your report, call the CRAs listed in the Yellow Pages under “credit” or “credit rating and reporting”. Call each credit bureau listed since more than one agency may have a file on you, some with different information. The three major national credit bureaus are: Equifax: (800) 685-1111 Experian (formerly TRW): (888) 397-3742 Trans Union: (800) 916-8800

Accurate Negative Info

When negative information in your report is accurate, only the passage of time can assure its removal. Accurate negative information can generally stay on your report for 7 years.

There are certain exceptions:

- Bankruptcy information may be reported for 10 years.

- Credit information reported in response to an application for a job with a salary of more than $75,000 has no time limit.

- Credit information reported because of an application for more than $150,000 worth of credit or life insurance has no time limit.

- Information about a lawsuit or an unpaid judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer.

- Adding Accounts to Your File

Your credit file may not reflect all your credit accounts. Although most national department stores and all-purpose bank credit card accounts will be included in your file, not all creditors supply information to CRAs: Some travel, entertainment, gasoline card companies, local retailers, and credit unions are among those creditors that don’t.If you’ve been told you were denied credit because of an ”insufficient credit file”or ”no credit file” and you have accounts with creditors that don’t appear in your credit file, ask the CRA to add this information to future reports. Although they are not required to do so, many CRAs will add verifiable accounts for a fee. You should, however, understand that if these creditors do not report to the CRA on a regular basis, these added items would not be updated in your file.